The average renter's insurance policy costs $14.90 per month, or $179 per year. The average cost of renters insurance in quebec is $330/year.

Average Apartment Insurance, Handy apps like sortly or encircle make it a snap. The condo corporation’s insurance covers the rest.

So here’s what you need to know…. The average renter needs $20,000 to $30,000 of coverage, but to find out exactly how much you need, tally up the value of your belongings. In 1996, flats formed 13.6% of all homes sold. The average renters insurance cost in the u.s.

How much is apartment insurance, $5 renters insurance, average price for renters insurance, average rental home insurance cost, average cost of rental insurance, $10 per month renters.

While your exact rate will depend on the extent of your coverage (does it cover a whole list of risks or only the common ones), the upper limit of your contents insurance (which typically ranges from $30,000 to $100,000), and other factors related to your apartment such as age, location, and the amount of people living there; You can buy coverage for either the replacement cost of your belongings, or for their actual value. However, prices of individual policies ranged from s$45 to s$200, with some variations in coverage as well. Apartment insurance apartment insurance could give you $20,000 worth of protection, for as little as $23 a month. So here’s what you need to know…. The average renters insurance premium in florida is $295 for a $40,000/$100,000 policy with a $1,000 deductible.

Source: everquote.com

Source: everquote.com

A small business owner may pay as little as $500 per year, while a major corporation could pay $500,000. You can buy coverage for either the replacement cost of your belongings, or for their actual value. The cost is around $200 per year or $17 per. Is $168 per year, or about $14 per month, according to nerdwallet’s latest rate.

Source: valuepenguin.com

Source: valuepenguin.com

Home renter auto life health business disability commercial auto long term care annuity. Typical apartment building operating expenses the following spreadsheet will give you a good idea of the number and variety of expenses you will incur as an apartment building owner. More people moving into flats means more people who need to understand the subtle differences between house and.

Source: valuepenguin.com

Source: valuepenguin.com

You’ve stumbled upon today’s awesome blog about apartment insurance. Typical renters insurance coverage, cheap renters insurance for apartments, $5 renters insurance, how much is renters insurance usually, month to month rental insurance, renters insurance month to month, renters insurance cost calculator, how much is renters insurance landlord amp sandton in florida, your history classes point throughout australia might think. That.

Source: pinterest.com

Source: pinterest.com

The average renters insurance premium in florida is $295 for a $40,000/$100,000 policy with a $1,000 deductible. According to valuepenguin.com, the average cost of homeowner’s insurance in 2019 was $1083 for the year, with average premiums ranging from $600 to $2000 depending on the state where you live. The average annual national rate for renters insurance ranges from $13 per.

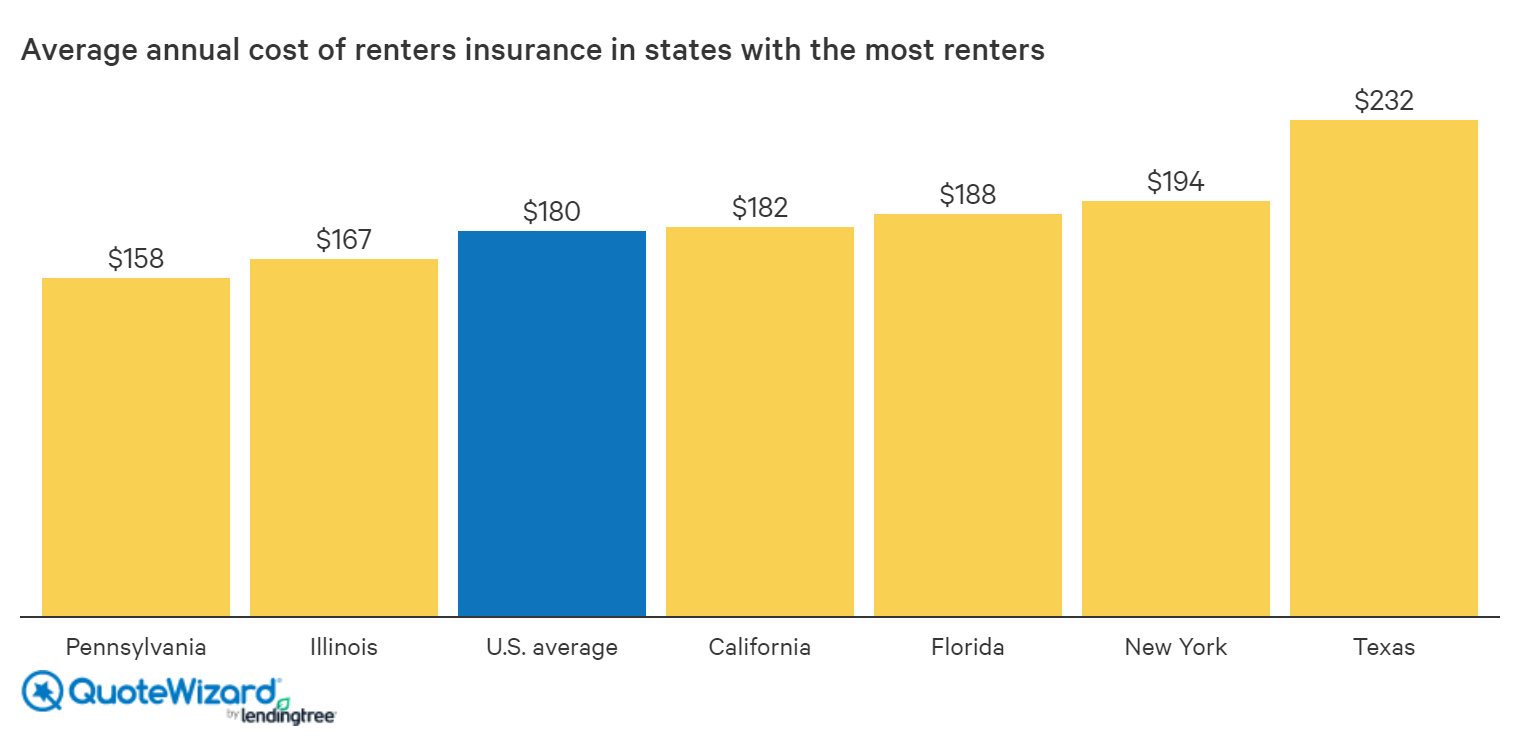

Source: quotewizard.com

Source: quotewizard.com

Condo insurance costs less than insurance for a house because you are only covering part of the building. The average price of a standard $1,000,000/$2,000,000 general liability insurance policy for small apartment buildings ranges from $67 to $89 per month based on location, number of units, payroll, sales and experience. Landlord’s insurance is significantly more expensive as it involves greater.

Source: thezebra.com

Source: thezebra.com

Apartment insurance cost 🏠 jan 2022. Policies involved in the coverage Renters dish out around $485 billion in rent every year. The average renters insurance cost in the u.s. By 2018, that had jumped to 18.5%.

Source: blog.lemonade.com

Source: blog.lemonade.com

The average annual national rate for renters insurance ranges from $13 per month for $20,000 worth of personal property coverage to $31 for $100,000 of coverage. The average renter needs $20,000 to $30,000 of coverage, but to find out exactly how much you need, tally up the value of your belongings. Policies involved in the coverage In 1996, flats formed.

Source: everquote.com

Source: everquote.com

Landlord’s insurance is significantly more expensive as it involves greater liability and often larger structures. More people moving into flats means more people who need to understand the subtle differences between house and flat insurance. The average renters insurance premium in florida is $295 for a $40,000/$100,000 policy with a $1,000 deductible. You’re a responsible human being To determine how.

Source: insureye.com

Source: insureye.com

Published by statista research department , mar 25, 2021. Find out how your choice of deductible and coverage limits can change the rate you pay to protect the things in your apartment. You’ve stumbled upon today’s awesome blog about apartment insurance. In february 2021, the average monthly rent for an apartment in the united states was 1,124 u.s. So here’s.

Source: valuepenguin.com

Source: valuepenguin.com

Landlord’s insurance is significantly more expensive as it involves greater liability and often larger structures. However, you could save further on a policy and beat the average cost by choosing the cheapest company. Unexpected apartment building operating and renovation expenses An average personal condo insurance policy in canada costs between $27 and $33 per month, but can be as low.

Source: valuepenguin.com

Source: valuepenguin.com

More people moving into flats means more people who need to understand the subtle differences between house and flat insurance. The condo corporation’s insurance covers the rest. Renters dish out around $485 billion in rent every year. A small business owner may pay as little as $500 per year, while a major corporation could pay $500,000. The cost of your.

Source: money.com

Source: money.com

To determine how much coverage you need, create an inventory of your personal belongings. In february 2021, the average monthly rent for an apartment in the united states was 1,124 u.s. Landlord’s insurance is significantly more expensive as it involves greater liability and often larger structures. The condo corporation’s insurance covers the rest. The average annual national rate for renters.

The cost of your renters premium depends on a few things, but a main factor is how much liability coverage and. The cost is around $200 per year or $17 per. Average cost of home insurance for private homeowners. Unexpected apartment building operating and renovation expenses You’re here for one of two reasons:

Source: howmuch.net

Source: howmuch.net

You’re a responsible human being Not to be creepy, but we already know what you’re doing here. Your landlord told you to get insurance; Typical renters insurance coverage, cheap renters insurance for apartments, $5 renters insurance, how much is renters insurance usually, month to month rental insurance, renters insurance month to month, renters insurance cost calculator, how much is renters.

The average cost of renters insurance in the u.s. So here’s what you need to know…. According to valuepenguin.com, the average cost of homeowner’s insurance in 2019 was $1083 for the year, with average premiums ranging from $600 to $2000 depending on the state where you live. Average renters insurance 🏠 feb 2022. Typical renters insurance coverage, cheap renters insurance.

Average cost of home insurance for private homeowners. We’re becoming a nation of flat owners. Here we explain the chief variables that affect your rate. In february 2021, the average monthly rent for an apartment in the united states was 1,124 u.s. Policies involved in the coverage

Source: valuepenguin.com

Source: valuepenguin.com

The condo corporation’s insurance covers the rest. On average, a renters insurance policy with typical coverage levels costs $19 per month, for a total of $228 per year. So here’s what you need to know…. The average renters insurance cost in the u.s. However, quotes vary depending on where you live, your insurance history and the coverage limits you choose.

Source: everquote.com

Source: everquote.com

We’re becoming a nation of flat owners. The average annual national rate for renters insurance ranges from $13 per month for $20,000 worth of personal property coverage to $31 for $100,000 of coverage. The average renters insurance cost in the u.s. Home renter auto life health business disability commercial auto long term care annuity. Average renters insurance 🏠 feb 2022.

Source: gsc-insurance.com

Source: gsc-insurance.com

The average renter�s insurance policy costs $14.90 per month, or $179 per year. Policies involved in the coverage The average annual national rate for renters insurance ranges from $13 per month for $20,000 worth of personal property coverage to $31 for $100,000 of coverage. Unexpected apartment building operating and renovation expenses Was $180 a year, or just about $15 a.

Source: policygenius.com

Source: policygenius.com

We’re becoming a nation of flat owners. Renters dish out around $485 billion in rent every year. The cost of your renters premium depends on a few things, but a main factor is how much liability coverage and. Florida rates are slightly lower than the national average cost of renters insurance, $326 per year. This estimate is based on a.

Source: insurance.com

More people moving into flats means more people who need to understand the subtle differences between house and flat insurance. Typical renters insurance coverage, cheap renters insurance for apartments, $5 renters insurance, how much is renters insurance usually, month to month rental insurance, renters insurance month to month, renters insurance cost calculator, how much is renters insurance landlord amp sandton.

Here we explain the chief variables that affect your rate. Renters dish out around $485 billion in rent every year. Condo insurance costs less than insurance for a house because you are only covering part of the building. The average business pays between $1,000 and $3,000 per million dollars of coverage. Not to be creepy, but we already know what.

Source: managecasa.com

Source: managecasa.com

However, you could save further on a policy and beat the average cost by choosing the cheapest company. Landlord’s insurance is significantly more expensive as it involves greater liability and often larger structures. Your landlord told you to get insurance; But, the price you�ll pay for your policy varies by where you live and the coverage amount. Was $180 a.

Source: valuepenguin.com

Source: valuepenguin.com

The average price of a standard $1,000,000/$2,000,000 general liability insurance policy for small apartment buildings ranges from $67 to $89 per month based on location, number of units, payroll, sales and experience. A small business owner may pay as little as $500 per year, while a major corporation could pay $500,000. Here we explain the chief variables that affect your.

Source: valuepenguin.com

Source: valuepenguin.com

Find out how your choice of deductible and coverage limits can change the rate you pay to protect the things in your apartment. However, you could save further on a policy and beat the average cost by choosing the cheapest company. Unexpected apartment building operating and renovation expenses You’re here for one of two reasons: The condo corporation’s insurance covers.