In our case, we are referring to the bonus depreciation made available by the “tax cuts and jobs act of. For eg if an asset is of rs.

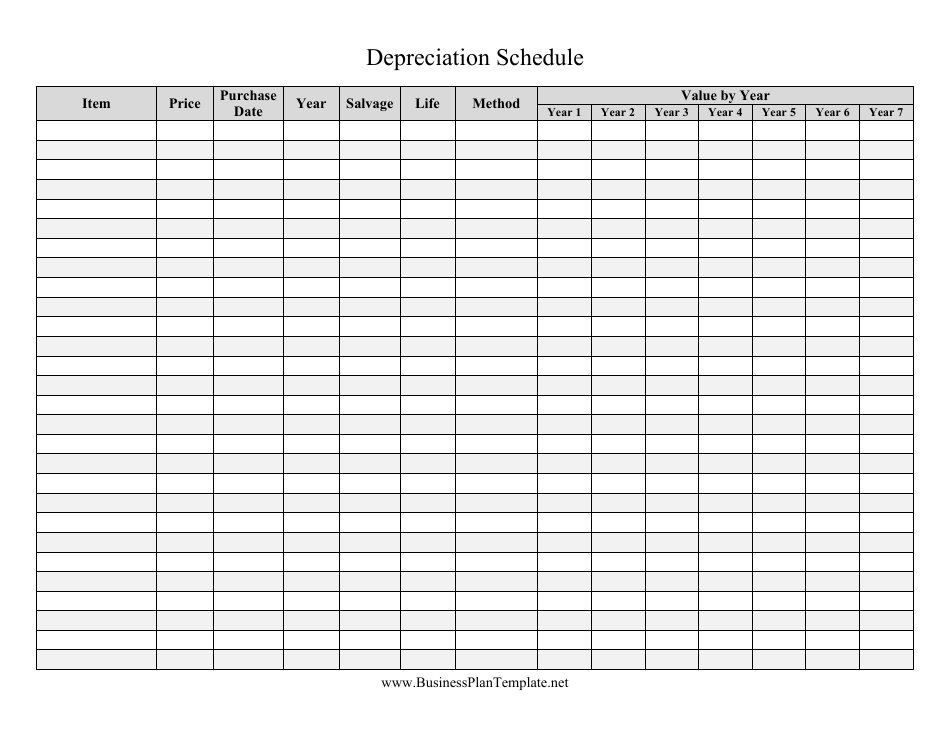

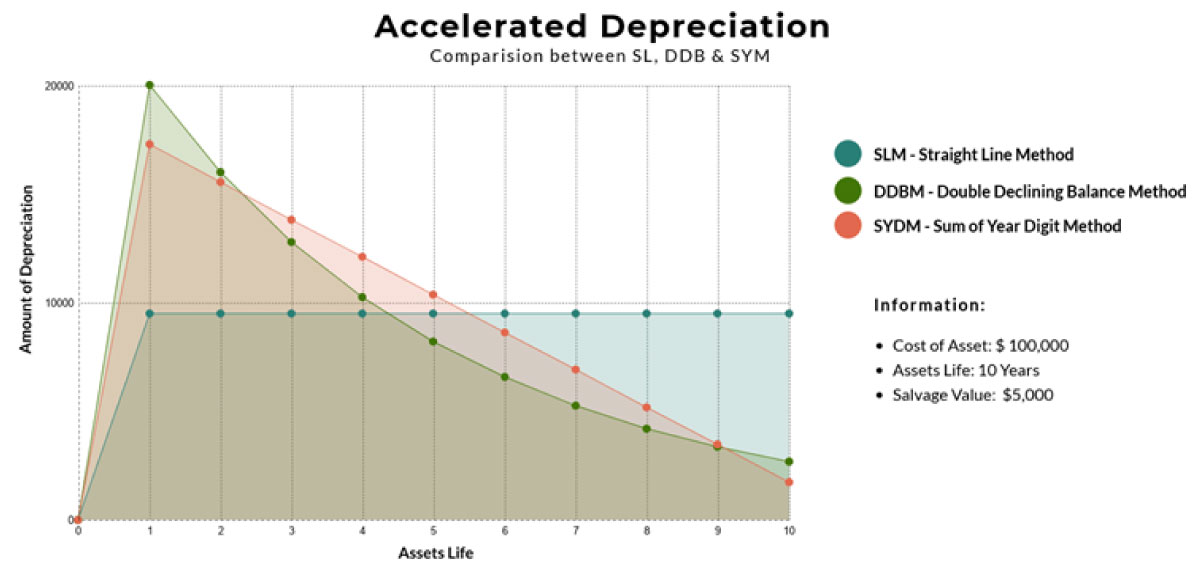

Apartment Depreciation Calculator, There are several options to calculate depreciation. In such cases, depreciation is arrived at through the following formula:

1 lakh and 80% depreciation is prescribed for the asset and you charge only rs. In our case, we are referring to the bonus depreciation made available by the “tax cuts and jobs act of. Calculate property depreciation with property depreciation calculator: Typically, this rate stands at 2.5%, which applies from the date of the property’s construction.

30,000 as depreciation, in this case next year wdv will be.

The value of a built structure decreases due to a reduction in the usable life span of the building. Check your property tax depreciation deductions today! The depreciation recapture tax rate is 25% and is applied to the total amount of the depreciation deductions you’ve made. Apartment cost segregation case study. Depreciation is based on the concept of an asset having a “useful life.” depreciation expense is meant to compensate a rental property owner for normal wear and tear to the building over a. Residential rental property owned for business or investment purposes can be depreciated over 27.5 years, according to irs publication 527, residential rental property.

For instance, if a buyer is selling a property after 10 years of construction, the selling price of the structure can be. This calculator performs calculation of depreciation according to the irs (internal revenue service) that related to 4562 lines 19 and 20. To calculate the depreciation of building component, take out the ratio of years of construction and total.

Source: engineeredtaxservices.com

Source: engineeredtaxservices.com

Check your property tax depreciation deductions today! Estimated deductable amounts for the first 10 fiscal years starting from the purchase date. Depreciation can be claimed at lower rate as per income tax act. The washington brown property depreciation calculator, is unique because it enables property investors to estimate the depreciation by simply inputting a purchase price. This was a difference.

Source: cabinet.matttroy.net

Source: cabinet.matttroy.net

This was a difference of $48 per week or $2,553 in just the first year. This calculator performs calculation of depreciation according to the irs (internal revenue service) that related to 4562 lines 19 and 20. Understanding how rental property depreciation works is a significant step to take toward building wealth in america. For example, assume you plan to buy.

Source: landlordo.com

Source: landlordo.com

In our case, we are referring to the bonus depreciation made available by the “tax cuts and jobs act of. This was a difference of $48 per week or $2,553 in just the first year. Let’s say, for instance, that in 2016 you bought an apartment for $200,000 and built a new bedroom for the unit for $40,000. Bonus depreciation.

This calculator performs calculation of depreciation according to the irs (internal revenue service) that related to 4562 lines 19 and 20. The bmt tax depreciation calculator helps you to estimate the likely depreciation deductions claimable for all types of property including residential, commercial and manufacturing buildings. For instance, if a buyer is selling a property after 10 years of construction,.

![[Solved] Evaluate the purchase of an existing 500 unit [Solved] Evaluate the purchase of an existing 500 unit](https://pictapart.github.io/img/placeholder.svg)

To claim the depreciation, though, you will need to have a prepared by one of our quantity surveyors. In our case, we are referring to the bonus depreciation made available by the “tax cuts and jobs act of. There are a few different methods that can be used to calculate appliance depreciation in rental properties. The bonus depreciation calculator is.

Source: ifonlysingaporeans.blogspot.com

Source: ifonlysingaporeans.blogspot.com

Typically, this rate stands at 2.5%, which applies from the date of the property’s construction. Number of years after construction / total useful age of the building = 20/60 = 1/3. A depreciation calculator is merely an accounting tool that helps investors save money by claiming the wear and tear of a property on their tax return. The value of.

Source: chegg.com

Source: chegg.com

For instance, if a buyer is selling a property after 10 years of construction, the selling price of the structure can be. To claim the depreciation, though, you will need to have a prepared by one of our quantity surveyors. Depreciation is based on the concept of an asset having a “useful life.” depreciation expense is meant to compensate a.

Source: flipboard.com

Source: flipboard.com

Using depreciation of 2.5% against its original construction cost, you could claim up to $5,000 annually against the income you receive from rent. This calculator performs calculation of depreciation according to the irs (internal revenue service) that related to 4562 lines 19 and 20. Check your property tax depreciation deductions today! Since you spread the depreciation deduction over 27.5 years,.

Source: chegg.com

Source: chegg.com

We would like to claim a depreciation on it, but it seems that there is no information regarding the division between the cost of the land and the cost of the apartment (because, well, it�s a single apartment floating in the air). Estimated deductable amounts for the first 10 fiscal years starting from the purchase date. The depreciation recapture tax.

Source: frommilitarytomillionaire.com

Source: frommilitarytomillionaire.com

We would like to claim a depreciation on it, but it seems that there is no information regarding the division between the cost of the land and the cost of the apartment (because, well, it�s a single apartment floating in the air). A depreciation calculator is merely an accounting tool that helps investors save money by claiming the wear and.

Source: researchgate.net

Source: researchgate.net

The bonus depreciation calculator is on the right side of the page. Bonus depreciation has different meanings to different people. There are several options to calculate depreciation. For eg if an asset is of rs. In our case, we are referring to the bonus depreciation made available by the “tax cuts and jobs act of.

To calculate the depreciation of building component, take out the ratio of years of construction and total age of the building. We would like to claim a depreciation on it, but it seems that there is no information regarding the division between the cost of the land and the cost of the apartment (because, well, it�s a single apartment floating.

Source: tronia.com

Source: tronia.com

We would like to claim a depreciation on it, but it seems that there is no information regarding the division between the cost of the land and the cost of the apartment (because, well, it�s a single apartment floating in the air). For eg if an asset is of rs. In theory, if i claim 100% of the cost basis.

Source: limblecmms.com

Source: limblecmms.com

To calculate the depreciation of building component, take out the ratio of years of construction and total age of the building. It is free to use, requires only a minute or two and is relatively accurate. You subtract off your tax basis in the property. 1 lakh and 80% depreciation is prescribed for the asset and you charge only rs..

Source: propertywalls.blogspot.com

Source: propertywalls.blogspot.com

Our property depreciation calculator helps to calculate depreciation of residential rental or nonresidential real property. As a property seller, suresh krishnan from chennai wants to know the resale value of an apartment, situated in the southern neighbourhood of the city and is 10 years old. 30,000 as depreciation, in this case next year wdv will be. If you still feel.

Source: financialmodelingacademy.com

Source: financialmodelingacademy.com

A bmt tax depreciation schedule reduced stephanie’s annual outlay for the property to $2,329 per annum or $45 per week. 1 lakh and 80% depreciation is prescribed for the asset and you charge only rs. It is free to use, requires only a minute or two and is relatively accurate. Case studies and figures are based upon tax depreciation schedules.

![[Solved] Evaluate the purchase of an existing 500 unit [Solved] Evaluate the purchase of an existing 500 unit](https://pictapart.github.io/img/placeholder.svg)

Cost segregation is a commonly used strategic tax planning tool that allows companies and individuals who have constructed, purchased, expanded or remodeled any kind of real estate to immediately reduce tax by accelerating depreciation deductions and deferring federal and state income taxes. This is the remaining useful age. A bmt tax depreciation schedule reduced stephanie’s annual outlay for the property.

Source: culturopedia.net

Source: culturopedia.net

The depreciation recapture tax rate is 25% and is applied to the total amount of the depreciation deductions you’ve made. It’s free to use and will quickly give you an estimate of much you can claim on your apartment. A depreciation calculator is merely an accounting tool that helps investors save money by claiming the wear and tear of a.

Source: realestate.com.au

Source: realestate.com.au

There are a few different methods that can be used to calculate appliance depreciation in rental properties. Check your property tax depreciation deductions today! For instance, if a buyer is selling a property after 10 years of construction, the selling price of the structure can be. In our case, we are referring to the bonus depreciation made available by the.

Source: templateroller.com

Source: templateroller.com

The results will display the minimum and maximum depreciation deductions that may be available for your investment property between 1 and 5 full years. Apartment cost segregation case study. Depreciation is one of the most significant tax advantages offered in the american tax system. A bmt tax depreciation schedule reduced stephanie’s annual outlay for the property to $2,329 per annum.

Source: seekingalpha.com

Source: seekingalpha.com

Fill out the details below to find out how much you could be saving. This is the remaining useful age. Depreciation can be claimed at lower rate as per income tax act. The value of a built structure decreases due to a reduction in the usable life span of the building. However, as apartments share common space among multiple units,.

Source: pinterest.com

Source: pinterest.com

The washington brown property depreciation calculator, is unique because it enables property investors to estimate the depreciation by simply inputting a purchase price. A bmt tax depreciation schedule reduced stephanie’s annual outlay for the property to $2,329 per annum or $45 per week. A regulation relating to ira rollovers stipulating that whenever a financial asset is withdrawn from a retirement.

Source: blog.capitalclaims.com.au

Calculate property depreciation with property depreciation calculator: The bmt tax depreciation calculator helps you to estimate the likely depreciation deductions claimable for all types of property including residential, commercial and manufacturing buildings. Estimated deductable amounts for the first 10 fiscal years starting from the purchase date. We would like to claim a depreciation on it, but it seems that there.

Source: archerinvestors.com

Source: archerinvestors.com

Since you spread the depreciation deduction over 27.5 years, you take the cost basis of the building (not the land!) and divide it by 27.5 years to calculate your annual depreciation amount. The value of a built structure decreases due to a reduction in the usable life span of the building. This calculator performs calculation of depreciation according to the.