It isn't impossible for people with bad or even average credit scores to land a rental in las vegas, but the process of securing an apartment might be a little more difficult. A good credit score can be instrumental to getting an apartment.

Average Credit For Apartment, Splitting expenses with a roommate will bring the total to $675/month. It depends on many factors.

Most people realize you need good credit to buy a home, but you also need good credit to rent an apartment. Here�s how to improve your chances of landing an apartment. Ways2rent has been providing renters with evictions and broken leases a simpler solution for no. A good credit score can be instrumental to getting an apartment.

Mississippi�s average estimated income of $60,776 was also well below the national average.

Beyond just being able to afford the cost of rent, many apartments now require that applicants have good credit to be approved for an apartment. For those who opened any type of mortgage tradeline in the past two years is 717. On average, americans carry $6,194 in credit card debt, according to the 2019 experian consumer credit review. A credit score can range from 300 to 850. However, finding an upscale or luxury no. That said, the ideal score depends on several factors, including your local rental market and whether you’re renting in a luxury building.

Source: themortgagereports.com

Source: themortgagereports.com

For some lenders, a credit score below 670 is considered subprime and would either lead to a denied application or the consumer being approved for less favorable terms. And alaskans have the highest credit card balance, on average $8,026. $112/month for the electric bill. Credit scores of 700 or better suggest good credit management, according to the credit bureau experian..

Source: creditwalls.blogspot.com

Source: creditwalls.blogspot.com

A monthly income of three to four times the rent and a fico score of 680 to 700 are considered ideal, but minor credit problems won�t necessarily keep you out of the apartment of your dreams, says rent money.com. Mississippi�s average estimated income of $60,776 was also well below the national average. Having a good credit score can play an.

Source: rentcafe.com

Source: rentcafe.com

When considering an applicant, credit is. Accordingly, can you get an apartment with a credit score of 500? Thus, while 620 is a good minimum credit score to shoot for, 650 is even better, and getting over 700 will allow you to move into even better apartments. According to a 2017 survey report from rentcafe, the average credit score of.

Source: pinterest.com

Source: pinterest.com

Breaking down a credit score. According to an analysis of more than 5 million rental applications by apartment industry blog rentcafé, the average u.s. However, that number can vary based on the market. Plus, credit scores can also vary widely in different types. A review of credit karma members shows the average vantagescore 3.0® credit score across the u.s.

Source: valuewalk.com

Source: valuewalk.com

Anything below 579 is very poor. It isn�t impossible for people with bad or even average credit scores to land a rental in las vegas, but the process of securing an apartment might be a little more difficult. 680 seems to be the sweet spot for most. However, finding an upscale or luxury no. However, that number can vary based.

Source: fi.pinterest.com

Source: fi.pinterest.com

Both a typical credit score and smartmove residentscore can help minimize risks when screening an applicant. Looking at vantagescore 3.0 credit scores from transunion for tens of millions of credit karma members who had a mortgage tradeline open on their credit report in the past two. The average credit score of apartment renters in the united states varies depending on.

Source: grow.acorns.com

Source: grow.acorns.com

Ways2rent has been providing renters with evictions and broken leases a simpler solution for no. However, finding an upscale or luxury no. On average, americans carry $6,194 in credit card debt, according to the 2019 experian consumer credit review. A monthly income of three to four times the rent and a fico score of 680 to 700 are considered ideal,.

Source: certifiedcredit.com

Source: certifiedcredit.com

The typical categories for those scores are: No credit check apartments are apartment units that don�t require a credit check as part of the rental process. Click to see full answer. Finding no credit check apartments has always been a challenge for renters with evictions, broken leases and low credit scores. Anything below 579 is very poor.

Source: thebalance.com

Source: thebalance.com

Anything above 750 is generally considered an excellent credit score. It isn�t impossible for people with bad or even average credit scores to land a rental in las vegas, but the process of securing an apartment might be a little more difficult. However, finding an upscale or luxury no. Landlords often perform a credit check on prospective tenants before renting.

Source: bankrate.com

Source: bankrate.com

680 seems to be the sweet spot for most. Apartment tenants often have lower credit scores than those seeking a mortgage, but landlords still have to assess risk.if your credit score is too low, then more than likely you�ll be facing denial.according to rentprep.com, the closer a tenant is to a score of 500, the more. The average credit score.

Source: propertynest.com

Source: propertynest.com

But don’t worry if you haven’t hit magic number 850. If you’re searching for an apartment in a competitive rental market, you may need a higher credit score and a higher income (use our rent calculator to determine how much you should pay monthly). And alaskans have the highest credit card balance, on average $8,026. There’s no universal standard for.

Source: shiftprocessing.com

Source: shiftprocessing.com

Click to see full answer. For some lenders, a credit score below 670 is considered subprime and would either lead to a denied application or the consumer being approved for less favorable terms. It depends on many factors. Your credit score is a vital part of your financial history used to indicate credit worthiness. How to rent an apartment with.

Source: themoneypixie.com

Source: themoneypixie.com

It isn�t impossible for people with bad or even average credit scores to land a rental in las vegas, but the process of securing an apartment might be a little more difficult. The average credit score of apartment renters in the united states varies depending on the type of building and the age of the renter. According to an analysis.

Source: creditkarma.com

Source: creditkarma.com

Generally, a higher credit score indicates a higher probability that you’re solvent and will be able. Plus, credit scores can also vary widely in different types. People with credit scores lower than 620 may indicate they are a high risk renter. On average, americans carry $6,194 in credit card debt, according to the 2019 experian consumer credit review. It doesn’t.

Source: crediful.com

Source: crediful.com

What credit score do you need to rent an apartment? However, recent surveys suggest that the average credit score for approved applicants for average apartments is 650. But don’t worry if you haven’t hit magic number 850. For some lenders, a credit score below 670 is considered subprime and would either lead to a denied application or the consumer being.

Source: rentcafe.com

Source: rentcafe.com

However, recent surveys suggest that the average credit score for approved applicants for average apartments is 650. A credit score can range from 300 to 850. It isn�t impossible for people with bad or even average credit scores to land a rental in las vegas, but the process of securing an apartment might be a little more difficult. Mississippi�s average.

Source: mysimplefreelife.com

Source: mysimplefreelife.com

In theory, any apartment could be a no credit check apartment. For those who opened any type of mortgage tradeline in the past two years is 717. What credit score do you need to rent an apartment? In fact, the average credit score needed to rent an apartment has been going up one point each year for the past three.

Source: blog.seattlepi.com

Source: blog.seattlepi.com

Accordingly, can you get an apartment with a credit score of 500? Breaking down a credit score. One estimate reckons the average cash difference between living a. According to a 2017 survey report from rentcafe, the average credit score of approved applicants was 650, while the average credit score of rejected applicants was 538. Renting in las vegas with bad.

Source: onettechnologiesindia.com

Source: onettechnologiesindia.com

It doesn’t have to be this way. Anything below 579 is very poor. Both a typical credit score and smartmove residentscore can help minimize risks when screening an applicant. However, finding an upscale or luxury no. However, it can be anything the landlord or management company deems creditworthy.

Source: jmzmanagement.com

Source: jmzmanagement.com

One estimate reckons the average cash difference between living a. 680 seems to be the sweet spot for most. No credit check apartments are apartment units that don�t require a credit check as part of the rental process. Landlords or property management companies want reassurance that you can pay your rent on time and you�re responsible, and a solid credit.

Source: creditreps.com

Source: creditreps.com

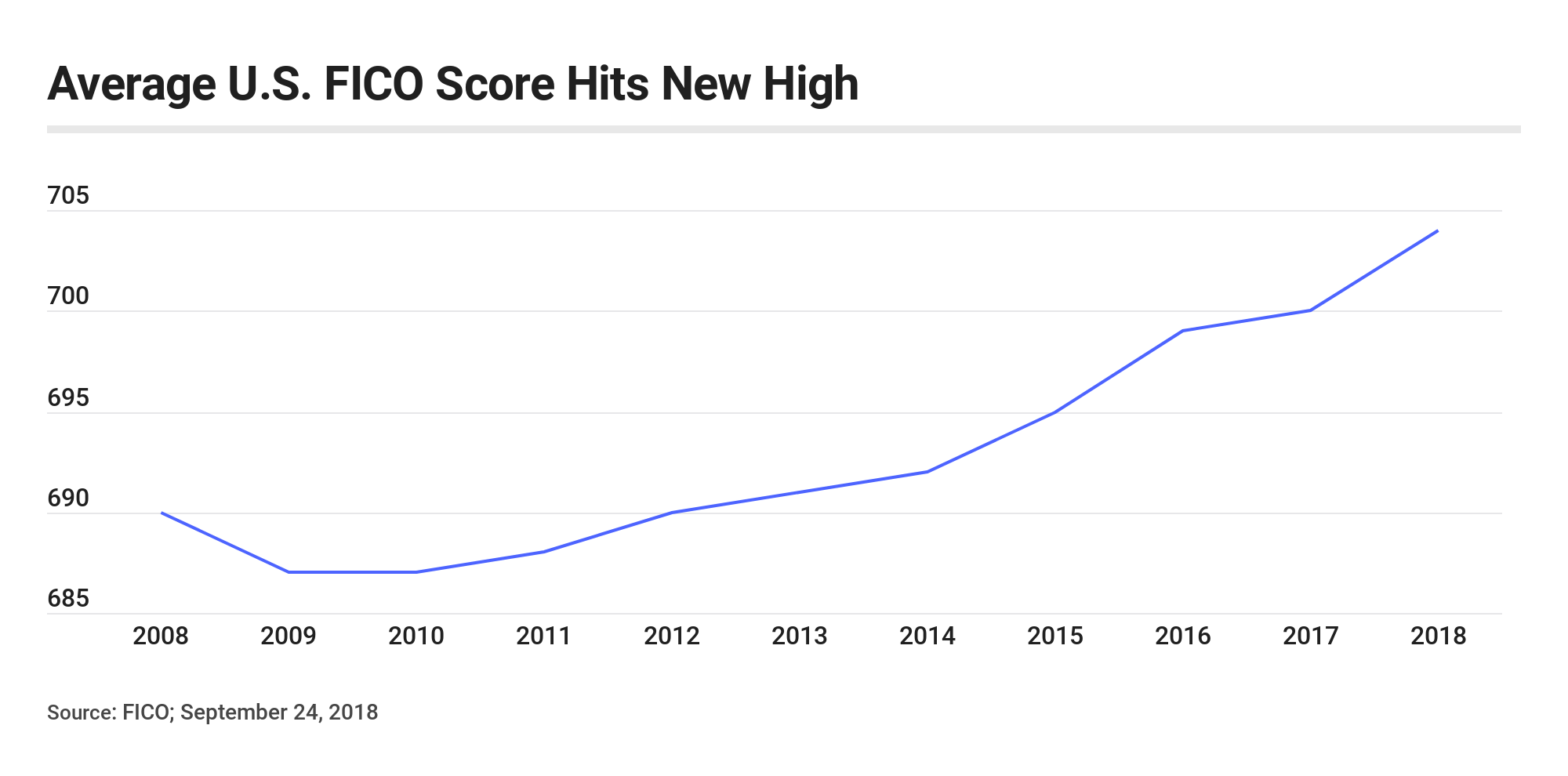

When considering an applicant, credit is. The average fico credit score was 689 out of 850 as of 2012, according to the credit.com website. However, finding an upscale or luxury no. Looking at vantagescore 3.0 credit scores from transunion for tens of millions of credit karma members who had a mortgage tradeline open on their credit report in the past.

Source: avail.co

Source: avail.co

That said, the ideal score depends on several factors, including your local rental market and whether you’re renting in a luxury building. Specifically, according to our analysis of more than 5 million lease applications nationwide, the average credit score of renters in the u.s. In theory, any apartment could be a no credit check apartment. Both a typical credit score.

Source: forbes.com

Source: forbes.com

Breaking down a credit score. When considering an applicant, credit is. According to a 2017 survey report from rentcafe, the average credit score of approved applicants was 650, while the average credit score of rejected applicants was 538. This is a shift from the traditional rental process, where landlords perform a credit check during the tenant screening process. A credit.

680 seems to be the sweet spot for most. The general range of fico credit scores are as follows. Breaking down a credit score. In fact, the average credit score needed to rent an apartment has been going up one point each year for the past three years. On average, americans carry $6,194 in credit card debt, according to the.

Source: inman.com

Source: inman.com

No credit check apartments are apartment units that don�t require a credit check as part of the rental process. The average fico credit score was 689 out of 850 as of 2012, according to the credit.com website. Specifically, according to our analysis of more than 5 million lease applications nationwide, the average credit score of renters in the u.s. It.